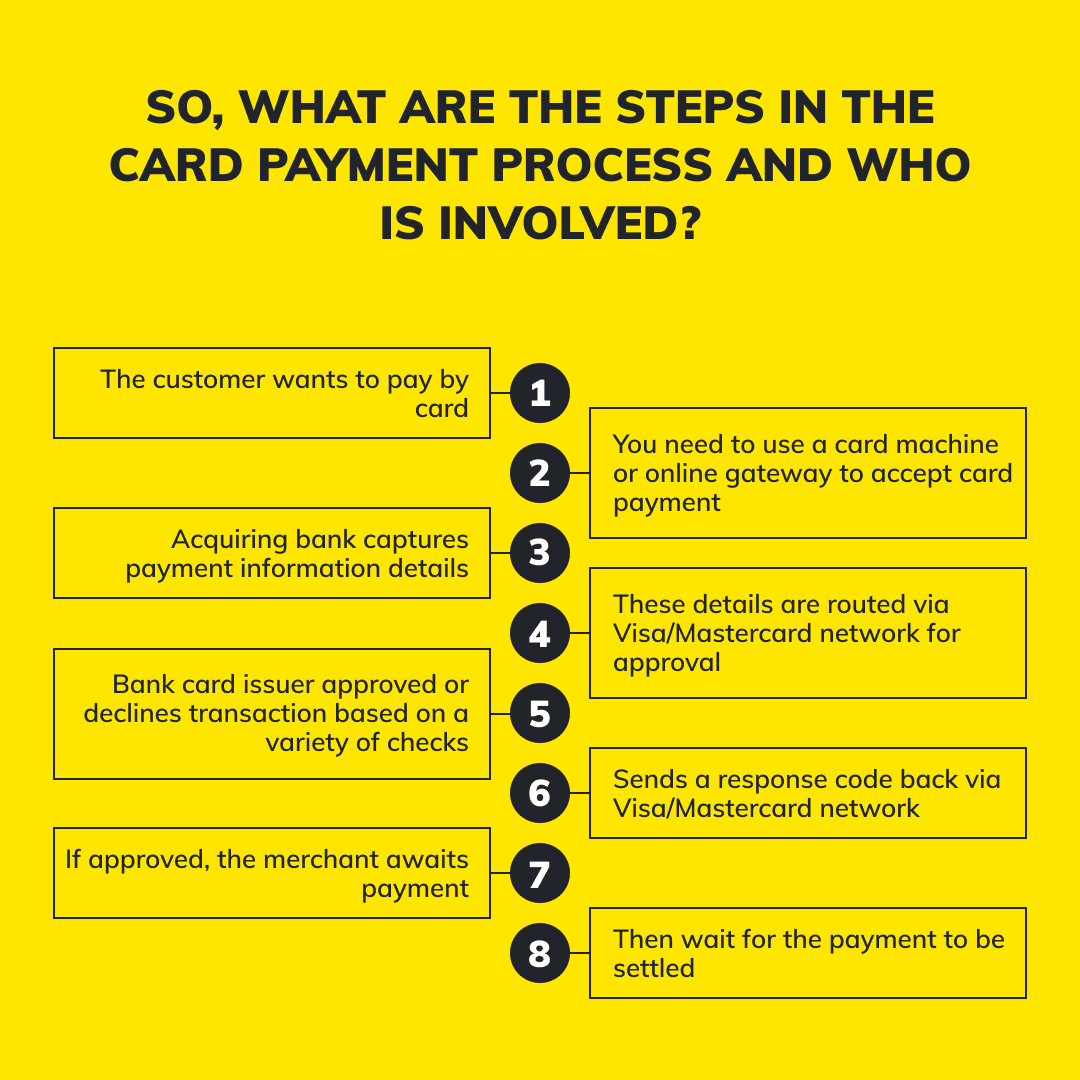

Do you know how many other organisations are involved when you accept a card payment from a customer? Or how much each middleman takes from your profits in the process?

While accepting card payments may seem convenient, there literally is a price to pay. Not just with the fees, but also with the days you have to wait to get paid, as well as the potential risk of card fraud.

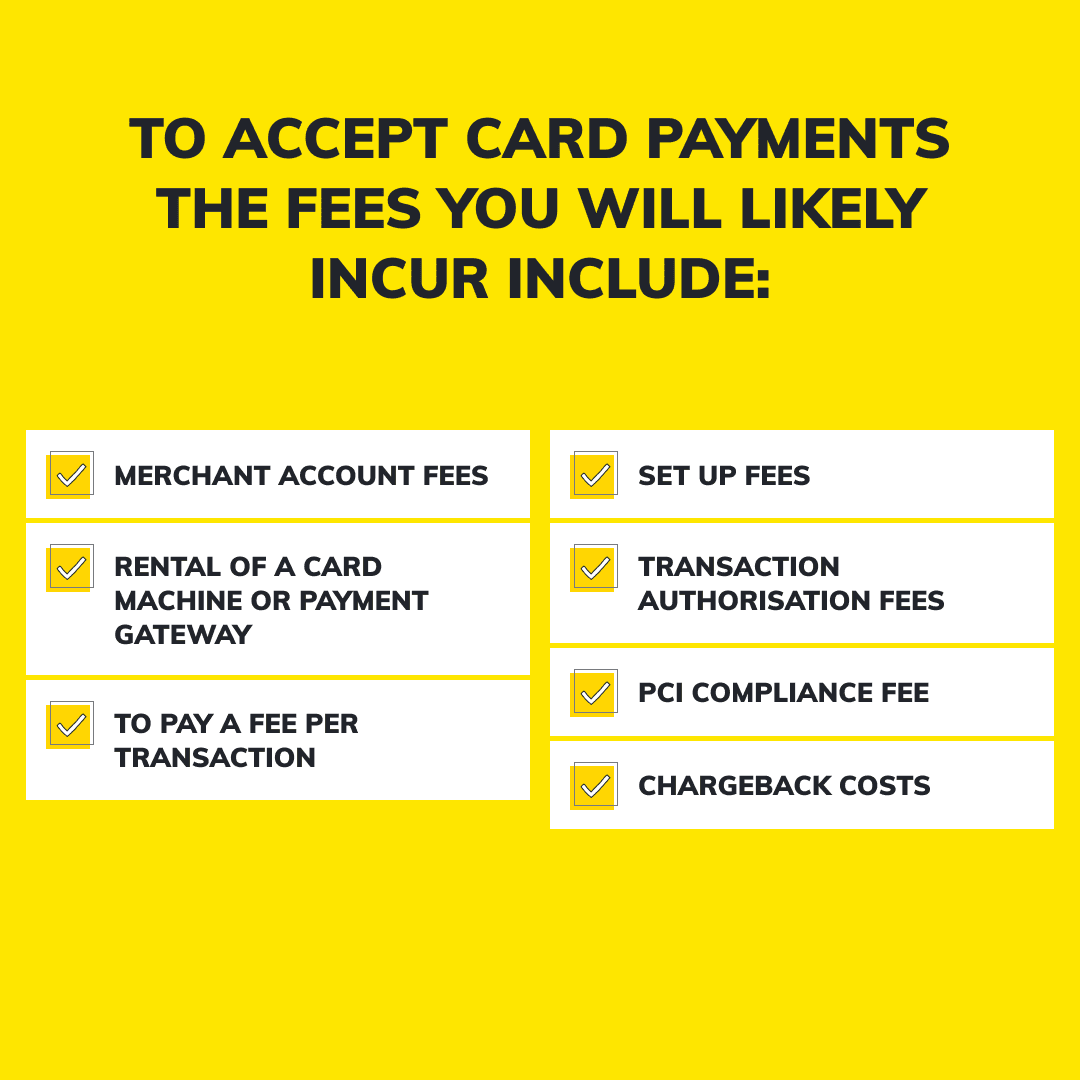

With all these steps involved in the process, what are the fees being charged and who is taking them?

Whether it is the bank, the card machine provider, the Visa/Mastercard network or some other regulatory authority, every fee taken is chipping away directly into your profits.

It might start off sounding quite minimal, but 2% here and 20p there, £5 for this and £10 for that, soon those charges start stacking up.

The good news is there is another way that you can accept payment easily and securely, plus you don't need to wait days for the funds to reach your account.

BOPP is a new way to make and receive payments. This new bank-to-bank payment app allows you to request a payment by creating a secure Paylink and sharing over email or messaging app, or creating a QR code. Because the app is linked to mobile banking apps and accounts are bank-verified it makes it even more secure than processing cards, plus as the payments are made instantly and the funds reach your account straightaway.

The best bit is rather than sharing your hard-earned profits with all the people in the card payment process, you pay just a single flat fee of £10 a month + vat for unlimited transactions.

There are over 30 million people with an online bank account who can use BOPP, so why wouldn't you chose this bank-to-bank payment app as your preferred way to collect payments.

BOPP is free for personal use, and the person paying doesn't need to download the app to pay you.